Vancouver, British Columbia, February 9, 2022 – Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is pleased to announce its Maiden National Instrument (“NI”) 43-101 Mineral Resource Estimates (“MRE”) for the Waterloo and Langtry silver properties, now collectively referred to as the Calico Silver Project1 (“Calico” or the “Project”), located in San Bernardino County, California. An Inferred resource estimate of 166 million ounces (“Moz”) of silver contained in 58.1 million tonnes (“Mt”) at an average grade of 89 grams per tonne (“g/t”) has been defined at Calico by Derek Loveday, P.Geo., of Stantec Consulting Services Ltd. (“Stantec”), the Company’s independent Qualified Person.

“This resource estimate represents the achievement of a significant milestone,” Apollo CEO, Tom Peregoodoff, commented. “The outcome we are announcing today confirms Calico as one of the largest undeveloped silver deposits in the USA and positions Calico as one of the largest globally. The conservative cut-off grade, low strip ratio, and coherent distribution of silver mineralization provide a solid foundation for Apollo to advance the project. Calico represents an exciting development opportunity and provides low risk leverage to future silver prices. For investors looking for exposure to silver in a Tier 1 jurisdiction, Calico represents a compelling opportunity.”

RESOURCE HIGHLIGHTS

- Robust Inferred MRE of 166 Moz silver contained in 58.1 Mt at an average grade of 89 g/t silver for Calico at a 50 g/t cut-off grade (see Table 1):

- Includes high-grade subset of 71 Moz silver contained in 15.9 Mt at an average grade of 139 g/t silver.

- The MRE is an optimized pit-constrained estimate supported by 42,091 m (138,094 ft) of historic drilling in 438 holes and incorporates recent geologic mapping and modeling.

- Base-case resource estimates reported in Table 1. Ounces are reported as troy ounces.

- Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions are followed for classification of the Mineral Resource.

- Prospects for eventual economic extraction determined using surface mining operating costs of US$2.50/st, processing costs of US$29.00/st and silver price of US$23.00/oz.

- Specific gravity for the mineralized zone is fixed at 2.44 kg/m3 (13.13 ft3/st). Silver grade was capped at 400 g/t only for Waterloo estimation.

- Resources are constrained to within an economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver.

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Derek Loveday, P. Geo. of Stantec Consulting Services Ltd. in conformance with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

*For the purposes of NI 43-101 reporting, the Waterloo and Langtry projects are now considered to be part of an expanded Calico Project, based on the reasonable expectation that if put into production, the deposits would likely share common infrastructure.

- Optimized pit-constrained resource uses conservative cut-off grade of 50 g/t silver

- The base-case cut-off grade (“COG”) was determined using the following assumptions:

- Silver price of US$23 per troy ounce (“oz”)

- Processing costs of US$29 per short ton (“st”).

- Mining costs of US$2.50/st

- Silver recovery of 80%

- Silver price was determined by averaging the price from the last 24 months up to December 31, 2021, based on data from the World Bank. Processing cost was based on published estimates for similar deposit types, cross-checked against historical processing costs determined by ASARCO in their 1980 historical feasibility study for Waterloo, and adjusted for inflation to 2022 prices. Increased silver prices, optimised processing parameters and/or improved silver recoveries will all impact the COG and the resultant MRE.

- The base-case cut-off grade (“COG”) was determined using the following assumptions:

- Resource estimates comprise oxide mineralization only

- The MRE is entirely contained within an extensive, near-surface oxidized silver mineralized zone that shows excellent continuity at both Waterloo and Langtry.

- The depth of the oxide/sulphide boundary below the current depth extent of the resource is poorly constrained, presenting opportunities to define additional oxide resource at depth. See Growth Opportunities section below.

- High continuity of shallow mineralization amenable to bulk mining methods

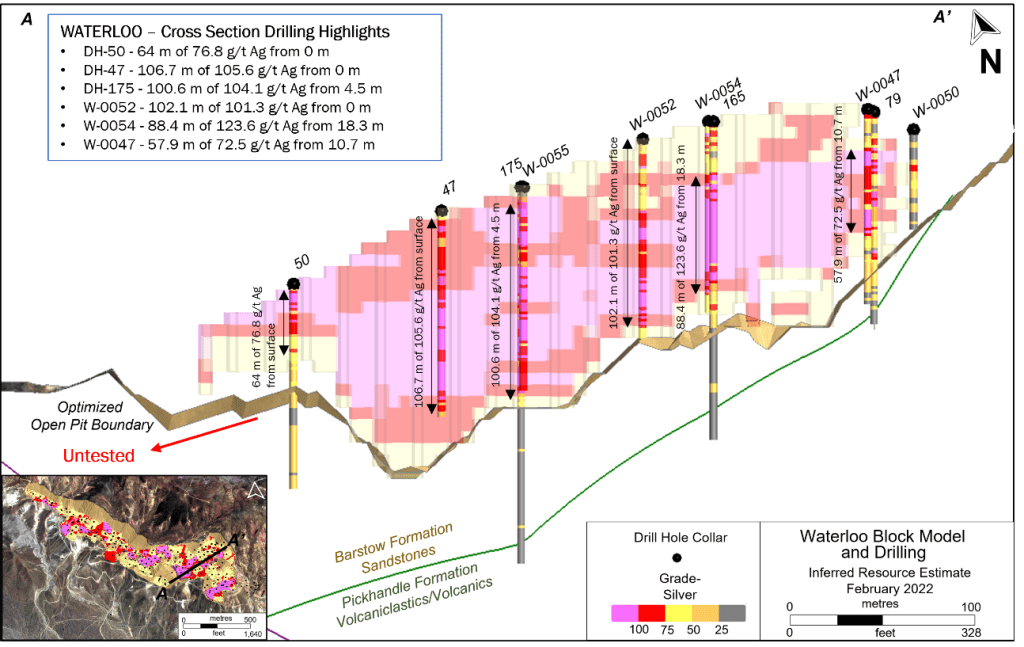

- The near-surface resource is calculated to a maximum depth below surface of ~125 m (415 ft) at Waterloo and 146 m (480 ft) at Langtry. Using conservative open pit optimization to determine reasonable prospects for economic extraction, the calculated waste to mineralized zone ratio for Waterloo is 2.2:1.

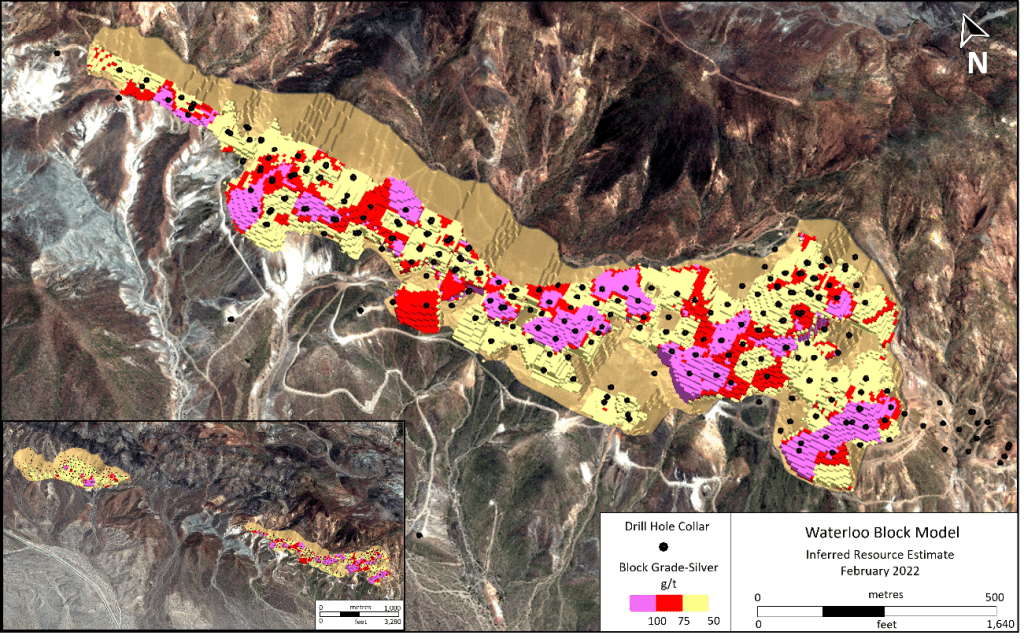

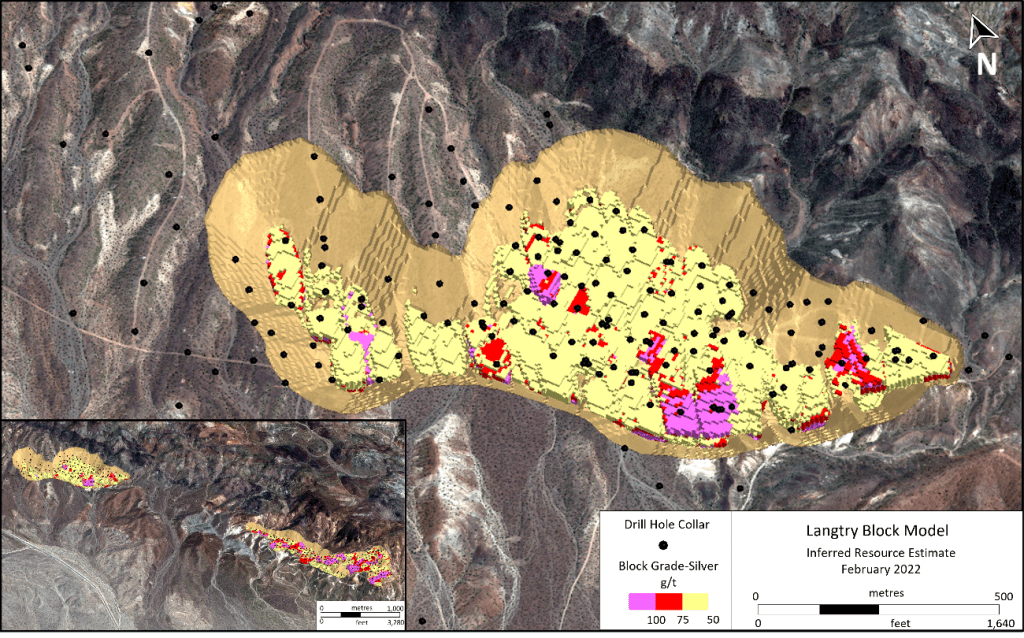

- Drilling demonstrates that mineralization is continuous and extensive: at Waterloo it extends along a strike length of 1,860 m (6,100 ft), and 1,250 m (4,100 ft) at Langtry.

- Significant resource growth opportunities identified

- Untested silver host stratigraphy identified below ~125 m (415 ft) within current resource extents and along strike at both Waterloo and Langtry.

- Expansion of high-grade silver mineralization.

- Gold and barite both have potential to make meaningful contribution.

- Clear path to resource advancement identified

- 2022 drill program designed to increase resource confidence and expand metal inventory.

- Metallurgical testing program defined. Results are expected in Q3 of 2022.

Refer to the Appendix for images of the Waterloo and Langtry mineral resource estimate block models.

“I am very pleased with the outcome of our MRE,” Apollo Vice President Exploration and Resource Development, Cathy Fitzgerald, commented. “Through this process we have confirmed the silver mineralization at Calico and firmly established that it is continuous over extensive strike lengths at both the Waterloo and Langtry deposits. Our teams’ focus now turns to drill testing the important resource growth opportunities that this work has confirmed and to upgrading the confidence in the current silver MRE. The upcoming, fully permitted drill program, together with the metallurgical work program we are commencing, will put us in an excellent position to update the MRE and commence initial engineering studies later this year.”

GROWTH OPPORTUNITES

- Several opportunities exist at Calico to expand silver mineralization within and near the current MRE footprint:

- Historical drilling is shallow (average drill hole depth at Waterloo was 73 m (240 ft) and at Langtry was 128 m (420 ft)). A number of holes terminated prior to intersecting the footwall contact and/or ended in mineralization. The opportunity exists to test for additional silver mineralization at depth within the mineralized Barstow formation.

- There are indications that footwall Pickhandle formation volcaniclastic rocks may also host disseminated silver mineralization. These remain poorly tested.

- At Langtry, extensive Quaternary cover is present, and many areas remain untested.

- Across the Project, several areas within or near the current MRE envelope have not been drill tested and have high potential to host silver mineralization.

- High-grade silver feeder zones require further drill testing and may add additional +100 g/t silver mineralization.

- Opportunity exists to expand the mineral inventory by defining the extent of gold and barite mineralization:

- The extent of gold mineralization remains poorly constrained. Drilling on the Waterloo property by previous operator Pan American Minerals Inc., identified a gold mineralized horizon 2 km northwest of the historical gold producing Burcham mine. This drilling intersected 25 m (true thickness) of 0.59 g/t at 132.60 m below surface, including 1.52 m of 5.52 g/t Au. This horizon is 60 m wide and 110 m in length (down-dip) and open in all directions. There is potential for meaningful gold mineralization along the entire 2.2 km long contact for which most historic drill holes did not test (see news release from January 11, 2022).

- Extent of barite mineralization remains poorly constrained. Historic assay techniques both at Waterloo and Langtry tended to under report barium because it was not consistently analyzed using appropriate methods. Analysis of historical pulps and duplicates along with new drilling material using ideal methods will be critical in defining the barite mineralization so that it may potentially be included in a MRE update.

RESOURCE ESTIMATION METHODOLOGY

The MRE was prepared in accordance with the requirements of the Canadian Institute of Mining Metallurgy and Petroleum’s (“CIM”) National Instrument 43-101 (“NI 43-101”) adopted May 2014. Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred MRE are uncertain in nature as there has been insufficient exploration to define these Inferred Resources as Indicated or Measured.

The MRE considered drilling information up to and including the most recently completed programs in 2012 and geological information from Apollo’s 2021 activities. Drilling information included exploration drilling records for a total of 438 drill holes; 255 holes, 18,626 m (61,108) at Waterloo and 183 holes, 23,465 m (76,986 ft) at Langtry. Nominal drill hole spacing is 40 x 45 m (140 x 150 ft) at Waterloo and 50 x 60 m (160 x 200 ft at Langtry. Average drill hole depths at Waterloo were 73 m (240 ft) and at Langtry 128 m (420 ft). Most holes are vertically oriented reverse circulation holes, with six holes being diamond drill holes.

The resource estimate only considered silver. Previously, barite has been included in historic resource statements however the assay technique used tended to under report barium concentration, rendering some of the barium data unreliable. Gold was evaluated but not enough data was available from drilling for it to be included in the MRE. Both represent growth opportunities as previously discussed.

The 3D resource block models were oriented along regional strike of mineralization controlling range front fault (Calico fault) and bedding, at approximately 045 degrees. Silver grades were estimated using ordinary kriging into a standard 20 ft x 20 ft x 20 ft block model using 15 ft drill hole composites and a bulk density of 2.44 kg/m3 (13.13 ft3/st). The block models are constrained to the west by the Calico range front fault and to the east by the contact between the mineralized Barstow formation sedimentary rocks and the Pickhandle formation rhyolitic rocks. Both structures are mineralization controlling features. A grade capping evaluation was performed, and silver grades were capped at 400 g/t Ag for the Waterloo resource estimate only. The near-surface resource is calculated to a maximum depth of ~125 m (415 ft) at Waterloo and 146 m (480 ft) at Langtry, both comprise only oxide mineralization. The calculated waste to ore ratio for Waterloo is 2.2:1 and for Langtry is 6:1.

Verification of exploration data used for MRE was performed by the independent Qualified Person. The MRE was internally audited and peer reviewed by Stantec prior to being released to Apollo and being declared final. Additionally, Apollo completed an internal review of the MRE as supplied by Stantec. A full description of the data and project verification process will be detailed in the technical report for the MRE, which will be prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects and filed within 45 days of this news release on Apollo’s website and on SEDAR at www.sedar.com.

Reasonable Prospects for Economic Extraction and COG Sensitivities

Reasonable prospects for eventual economic extraction were assessed by calculating a base-case COG for silver at 50 g/t. This was achieved by estimating a surface mining operating cost of US$2.50/st, processing operating cost of US$29.00/st and silver price of US$23.00/oz. Block revenue estimates for silver grade blocks greater than 50 g/t, less surface mining costs, were used to generate an optimized Lerchs-Grossman economic pit shell at constant slope of 45 degrees and constrained to within the property claim boundaries.

The processing cost chosen for the MRE was based on published estimates for similar deposit types and cross checked against historical processing costs determined by ASARCO in their 1980 historical feasibility study for Waterloo, adjusted for inflation to 2022 prices. The silver price was determined by averaging the price from the last 24 months up to end-December 2021, based on data from the World Bank.

Variations in processing costs, silver price and silver recovery may impact COG and the resultant MRE. A sensitivity analysis was undertaken to examine the impacts of changing these variables on the MRE at Calico (see Table 2).

- Base-case resource estimates reported in Table 1. Ounces are reported as troy ounces.

- Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions are followed for classification of the Mineral Resource.

- Prospects for eventual economic extraction determined using surface mining operating costs of US$2.50/st, processing costs of US$29.00/st and silver price of US$23.00/oz.

- Specific gravity for the mineralized zone is fixed at 2.44 kg/m3 (13.13 ft3/ton). Silver grade was capped at 400 g/t only for Waterloo estimation.

- Resources are constrained to within an economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver.

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Derek Loveday, P. Geo. of Stantec Consulting Services Ltd. in conformance with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

ABOUT THE CALICO PROJECT

Location

The Project is located in San Bernardino County, California and comprises the adjacent Waterloo and Langtry properties which total 2,950 acres. The Project is 15 kilometers (9 miles) from the city of Barstow and has an extensive private gravel road network spanning the property. There is commercial electric power within 5 kilometres (3 miles) of the Project.

Geology and Mineralization at Calico

The Calico Project is situated in the southern Calico Mountains of the Mojave Desert, in the south-western region of the Basin and Range tectonic province. This mountain range is a 15 km (9 mile) long northwest-southeast trending range dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico comprises high-level low-sulfidation silver-dominant epithermal vein-type and disseminated-style deposits associated with northwest-trending faults and fracture zones and mid-Tertiary volcanic activity. The Project represents a district-scale mineral system endowment with approximately 6,000 metres (19,685 feet) in mineralized strike length controlled by Apollo. Oxidized, disseminated and stockwork-style mineralization is primarily hosted in the Barstow sedimentary formation and is the focus of this MRE.

QUALIFIED PERSONS

Derek Loveday, P.Geo., of Stantec Consulting Services Ltd., is an independent Qualified Person as defined by NI 43-101 Standards of Disclosure for Mineral Projects. Mr. Loveday has supervised and approved the technical contents of this news release as it pertains to the disclosed Mineral Resource Estimates. Mr. Loveday is a registered Professional Geoscientist, registered in Alberta, Canada.

The scientific and technical data contained in this news release was also reviewed, and approved by Cathy Fitzgerald, P.Geo., Apollo’s Vice President Exploration and Resource Development, a Qualified Person as defined by NI 43-101 Standards of Disclosure for Minerals Projects. Ms. Fitzgerald is a registered Professional Geoscientist in British Columbia, Canada.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Tom Peregoodoff

Chief Executive Officer

For further information, please contact:

Tom Peregoodoff

Chief Executive Officer

Telephone: +1 (604) 428-6128

tomp@apollosilver.com

About Apollo Silver Corp.

Apollo Silver Corp. has assembled an experienced and technically strong leadership team who have joined to advance world class precious metals projects in tier-one jurisdictions. The Company is focused on advancing its portfolio of two significant silver exploration and resource development projects, the Calico Silver Project, in San Bernardino California and Silver District Project in Arizona.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the potential of the Calico Project; the potential for identification of gold and barite resources at Calico; the potential to expand the resource estimate and upgrade its confidence level, including prospective mineralization on strike and at depth. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; contests over title to properties; changes in project parameters as plans continue to be refined; and impact of the COVID-19 pandemic. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.