VANCOUVER, British Columbia, May 12, 2021 (GLOBE NEWSWIRE) — Apollo Gold & Silver Corp. (“Apollo” or the “Company”) (TSX.V: APGO) is pleased to announce it has entered into a definitive acquisition agreement (the “Agreement”) dated May 11, 2021, to acquire all the issued and outstanding shares (the “Transaction”) of privately held Stronghold Silver Corp. (“Stronghold”). Stronghold holds rights to three large scale silver projects: Waterloo and Langtry in California and The Silver District in Arizona. Upon closing of the Transaction Apollo will become a leading US focused silver exploration and development company.

Highlights:

- A US based pure silver opportunity with three advanced assets in mining friendly regions of Southeast California and Arizona;

- Over 100 million (M) ounces of silver in one of three historic resources(1). Significant exploration upside;

- US critical mineral status due to barite content and growing importance of silver in clean energy applications; and

- Appointment of Tom Peregoodoff as President and CEO of the Company with further additions to the board of directors.

The combination of Apollo and Stronghold creates a team with deep technical and operational experience, a strong profile in capital markets and a broad and supportive shareholder base. The Stronghold silver assets represent some of the largest, undeveloped, advanced silver projects in the US. In addition, the assets are silver-barite systems with 10-12% barite, a mineral deemed critical to the US economy and sourced primarily through importation, with China the major supplier.

Commenting on today’s announcement, Apollo Chairman, Andrew Bowering said, “the signing of this agreement is a major achievement and a transformational moment for Apollo shareholders. We look forward to establishing the Company’s presence in the US and the silver sector as a major player as we focus our efforts on unlocking value at Waterloo, Langtry and The Arizona Silver District with new exploration activities. I am also delighted to welcome Tom Peregoodoff to our team. His experience, knowledge and relationships will be instrumental as we drive forward these high-profile projects.”

“With the definitive agreement signed we look forward to completing this transaction with our new partners at Apollo,” said James Hynes, Stronghold CEO. “We are very excited about the future for these projects as silver continues to build momentum in new, as well as traditional, applications. We are confident in the Apollo team’s ability to drive future value as we expand on the strong fundamentals of the combined assets.”

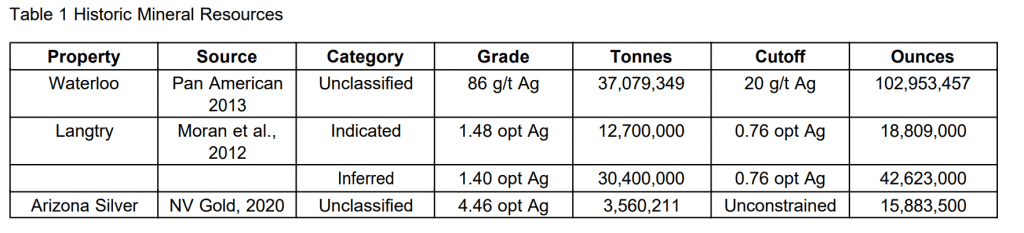

(1) See Cautionary Note regarding historic mineral resources presented below in Table 1. Reference to historic resources at Waterloo refer to Kirkpatrick, R.K, 1966, Waterloo Ore Reserve, Calico Mining District, Asarco Inc. Internal Report, dated December 1, 1966 and Waterloo Project, internal company report prepared by Pan American Minerals Corp., dated 2013, unpublished. Reference to historic resources at Langtry refer to Moran et al, 2012, NI 43101 Technical Report, Langtry Silver Project, San Bernardino County, California: prepared for Athena Silver Corp, April 2012. Reference to historic resources at Arizona Silver District refer to Fox, 1991, Summary Report, Orbex internal Company report, 1991, unpublished and NV Gold Corporation, 2020, Company news release dated January 13, 2020 [Online] available at https://www.nvgoldcorp.com/news/nv-gold-signs-binding-loi-for-option-to-acquire-10-1788/, [Accessed April 30, 2021].

The historical mineral resources discussed in this press release were calculated prior to the implementation of the standards set forth in NI 43-101 and current CIM standards for mineral resource estimation (as defined by the CIM Definition Standard on Mineral Resources and Ore Reserves dated May 10, 2014). The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. The estimates do not classify the resource as either a measured, indicated or inferred resource and, accordingly, readers should not assume it satisfies the requirements of any of such classifications. There is insufficient information available to properly assess the data quality, estimation parameters and standards by which the estimates were categorized. An independent Qualified Person (‘QP’), has not done sufficient work to classify the estimate discussed as current mineral resources or reserves and therefore the estimate should be treated as historical in nature and not current mineral resources or mineral reserves. The historical resources have been included simply to demonstrate the mineral potential of the projects. A thorough review of all historical data performed by a QP, along with additional exploration work to confirm results, would be required in order to produce a current mineral resource estimate for all projects.

Terms of the Transaction:

Under the terms of the Agreement, Apollo will issue a total of 40 M common shares to Stronghold shareholders on a share exchange ratio of one Apollo common share for one Stronghold common share (the “Exchange Ratio”). The Transaction is expected to constitute a “fundamental acquisition” of Stronghold by the Company pursuant to TSX Venture Exchange (the “Exchange”) Policy 5.3 and will require approval of the Exchange and be subject to requirements the Exchange may impose. In addition, it is a condition of closing that Apollo must complete a financing of a minimum of C$35,000,000 (the “Concurrent Financing”) the details of which will be released in due course. There are a number of other closing conditions as are customary for transactions of this nature.

Finally, in the event the Transaction is not completed on or before June 30, 2021, the Agreement will terminate unless mutually agreed.

About the Stronghold Assets:

Pursuant to various option agreements, Stronghold holds the right to acquire a 100% interest in The Waterloo, Langtry and Arizona Silver District Projects.

Calico Project – Waterloo and Langtry

Upon close of the Transaction Apollo, will consolidate the Waterloo and Langtry projects under a single project to be known as the Calico Project. The Calico Project is located in the historic mining district of Calico located 16 kilometres (“km”) from Barstow California in San Bernardino County. Once the largest silver producing regions in the US (1882 – 1940), the project has had significant exploration work performed by previous operators including: Asarco (1964 – 1994) and Pan American Silver (1994 – 2020) at the Waterloo Project; and Superior (1967-1987) and Athena (2012-2020) at the Langtry Project.

The Waterloo Purchase Agreement

Stronghold USA, as Purchaser, and Pan American Minerals Inc (a wholly owned subsidiary of Pan American Silver Corp) (“Pan American”), as Vendor, entered into an asset purchase agreement dated January 22, 2021 (the “Waterloo Purchase Agreement”) which gave Stronghold the right to purchase 100% interest in the Waterloo Project for a consideration of US$25,000,000. Stronghold USA and Pan American have entered into subsequent amendments extending the closing of the transaction to May 31, 2021 in consideration of a non-creditable payment by the Purchaser to the Vendor of US$1,000,000 (paid) with a further extension to June 30, 2021 for consideration of a non-creditable payment by the Purchaser to the Vendor of an additional US$1,000,000 (unpaid). Pan American will retain a 2% Net Smelter Royalty on any future production of minerals from the project. To date, a total of US$2,750,000 in deposits have been paid to Pan American and will be credited against the total consideration.

In addition, within 15 days of the close of the Transaction, Apollo will issue to Pan American notice providing Pan American with ten business days to elect to receive either 1) an additional US$6,000,000 or 2) the equivalent of US$6,000,000 in common shares of Apollo based on the 10-day VWAP calculated 10 trading days after the close of the Transaction.

The Langtry Option Agreements

Athena Agreement

Stronghold as optionee and Athena Minerals Inc (“Athena”, a wholly owned subsidiary of Athena Silver Corporation) as optionor entered into an Option to Purchase Agreement dated December 21, 2020 which gives Stronghold the right to acquire 100% interest in certain lands forming a portion of the Langtry Project (“Athena Lands”) for an aggregate purchase price of US$1,000,000 to be made on or before December 21, 2025.

Terms of the option include US$15,000 upon closing (paid) and US$25,000 on each anniversary of the effective date. All payments made by the optionee to the optionor during the 24-month period prior to the full exercise of the option shall be credited against the purchase price.

Upon vesting of 100% interest, Stronghold will grant to Athena a 1% Net Smelter Royalty on any future production of minerals from the Athena Property subject to the royalty shall only apply on those Athena Lands that currently do not have existing royalties of 1% or higher such that at no time will any property have a royalty of greater than 2%.

Strachan Agreement

Stronghold USA, as optionee, and Bruce D. Strachan and Elizabeth Strachan as Trustees of the Bruce and Elizabeth Strachan Recoverable Living Trust dated 7-25-2007 (“Strachan”) as optionor entered into an Option to Purchase Agreement dated December 23, 2020 (the “Strachan Agreement”) which gives Stronghold the right to acquire 100% interest in lands forming a portion of the Langtry Project (“Strachan Lands”) for the aggregate purchase price of the greater of 1) US$5,200,000 or 2) spot price of 220,000 troy ounces of silver, on or before December 24, 2025.

Under the terms of the Strachan agreement Stronghold is required to pay US$100,000 on each anniversary of the effective date to keep the option in good standing. All payments made during the term of the option shall be applied to the purchase price.

Upon full exercise of the option, Stronghold will grant to Strachan the following royalties: 1) a 1% Net Smelter Royalty on any future production of silver from the Strachan Lands; 2) 5% gross royalty on all other mineral production and 3) 10% gross royalty on all other non-mineral production income derived from any other commercial use of the property.

Arizona Silver District Project

This district-scale property position is located in the heart of the historic Silver District in Southwest Arizona. The project covers over 2,000 acres and includes mineral title covering three major epithermal vein structures (West, Central, East), having a collective strike length of 13 kms. Previous drilling is limited to approximately 45 m vertical depth opening up significant discovery potential.

Stronghold USA as optionee and Gulf + Western Industries Inc (“Gulf”), as optionor, entered into an Option to Purchase Agreement dated January 22, 2021 which gives Stronghold the right to acquire 100% interest in lands forming the Arizona Silver District Project for an aggregate purchase price of US$2,000,000 to be made on or before January 22, 2026.

Terms of the option include 1) US$70,000 upon closing (paid); 2) US$100,000 and US$100,000 in common shares of Stronghold on 12 month anniversary of the effective date; 3) US$125,000 on 24 month anniversary and US$125,000 in common shares of Stronghold of the effective date; 4) US$175,000 and US$175,000 in common shares of Stronghold on 36 month anniversary of the effective date; 5) US$250,000 and US$250,000 in common shares of Stronghold on 48 month anniversary of the effective date; 6) US$300,000 and US$300,000 in common shares of Stronghold on 60 month anniversary of the effective date.

Additional bonus payments will be made by Stronghold in the following events; 1) US$250,000 and US$250,000 in common shares of Stronghold in the event the property becomes the flagship property of the company within 36 months of the effective date; 2) Stronghold declares a 43-101 compliant resource of at least 30 M ounces silver within 36 months of the effective date; 3) US$3,000,000 in the event that the price of silver exceeds US$125/ounce for ninety days on of before the 60 month anniversary of the effective date.

Following the completion of the Transaction all share issuances shall be made in Apollo common shares. All common shares shall be issued at a price equal to the prior 10-day VWAP and will be subject to Exchange approval.

Upon vesting of 100% interest, Stronghold will grant to Gulf a 2% Net Smelter Royalty on any future production of minerals from the property.

Changes to the Board and Management

In addition to the above Transaction, the Company is pleased to announce certain changes to its board of directors (“board”) and management. Effective May 1, 2021, Tom Peregoodoff will be appointed President and Chief Executive officer and will join the board. In addition, upon close of the Transaction, James Hynes will be appointed to the board of Apollo.

Simon Clarke will step down as CEO but remain on the board. The Company would like to thank Mr. Clarke for his valuable contribution and leadership and the vital role he has played in the growth of Apollo to date.

Incoming CEO, Tom Peregoodoff, commented, “I am very pleased to have the opportunity to join this dynamic group. I very much look forward to working with the team as we deliver on our stated objective of creating an intermediate US focused pure silver company and realize the value of our portfolio of high-quality advanced silver assets. I am also thrilled that Simon will remain on the board and continue to provide his counsel as we move forward.”

Tom Peregoodoff, President and Chief Executive Officer, Director

Mr. Peregoodoff has over 30 years of mineral resource exploration and development experience. His last management position was President and CEO of Peregrine Diamonds Ltd. where he led the company from the resource development phase through to the eventual sale to DeBeers Canada in 2018.

Mr. Peregoodoff spent 18 years in several positions with the mining multinational BHP. His final role was Vice President of Early-Stage Exploration, with global responsibility for all early-stage exploration across their commodity groups.

Mr. Peregoodoff serves as a director of Pretium Resources Inc, Mountain Province Diamonds Inc. and Tempus Resources Limited of Perth, Australia. Mr. Peregoodoff holds a BSc. in Geophysics from the University of Calgary.

James Hynes, Director

Mr. Hynes, founder of Stronghold, is a geological engineer and entrepreneur with over 20 years of experience in the mining and metals sector. Mr. Hynes is also the Founder and Executive Chairman of both KORE Mining (KORE on the TSX.V) and Karus Gold (anticipated listing on the TSX.V in Q2 2021).

Qualified Person

Dean Besserer, P.Geo., Vice President Exploration, is a Qualified Person as defined by National Instrument 43- 101 and has reviewed and approved the technical content in this news release.

About Apollo Gold and Silver Corp.

Apollo Gold & Silver has assembled an experienced and technically strong leadership team who have joined to advance world class precious metals deposits in tier-one jurisdictions with focus on the Americas.

About Stronghold Silver

Stronghold Silver is a private US-focussed pure silver development company which has recently entered into definitive agreements to consolidate and advance three significant pure silver development projects in well established and prolific mining jurisdictions. The Calico Silver District Project is comprised of the historical Waterloo and Langtry Deposits, in San Bernardino California and Silver District Project in Arizona with significant historic drilling database with large exploration upside with new unexplored land packages.

ON BEHALF OF THE BOARD OF DIRECTORS

Simon Clarke

Chief Executive Officer

For further information, please contact:

Simon Clarke.

Chief Executive Officer, Director

Telephone: +1 (604) 551-9665

simonpclarke65@gmail.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in the Company’s periodic filings with Canadian securities regulators. When used in this news release, words such as “will”, “could”, “plan”, “estimate”, “expect”, “intend”, “may”, “potential”, “appear”, “should,” and similar expressions, are forward-looking statements.

Although Apollo Gold and Silver Corp. has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward-looking statements may differ materially from actual results or events.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this news release, and the Company disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Cautionary Statement Regarding Historic Estimates

Any reference to historical estimates and resources should not be relied upon. These are not current and a Q.P. has not done sufficient work to classify these historical estimate and Apollo is not treating the historical estimate as a current resource estimate. This document uses the terms “ resources”, “measured resources”, “indicated resources” and “inferred resources”. United States investors are advised that, while measured resources, indicated resources and inferred resources are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission (the “ SEC”) does not recognize them Under United States standards, mineralization may not be classified as a “reserve” unless the

determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher category. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this release may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC. National Instrument 43 101 Standards of Disclosure for Mineral Projects (“NI 43 101”) is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Historical resource estimates contained in this document have not been prepared in accordance with NI 43 101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System.