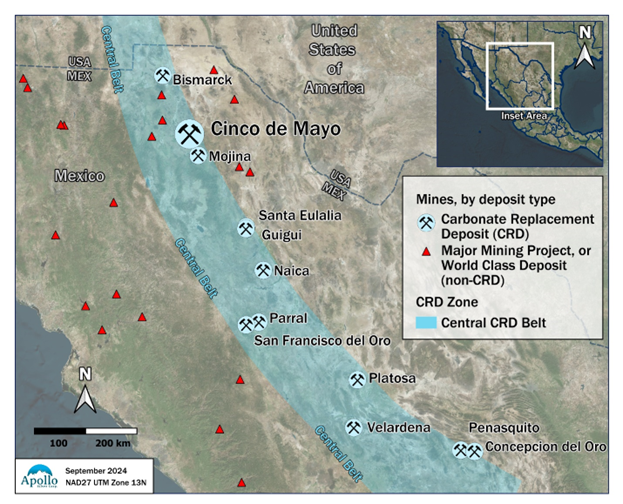

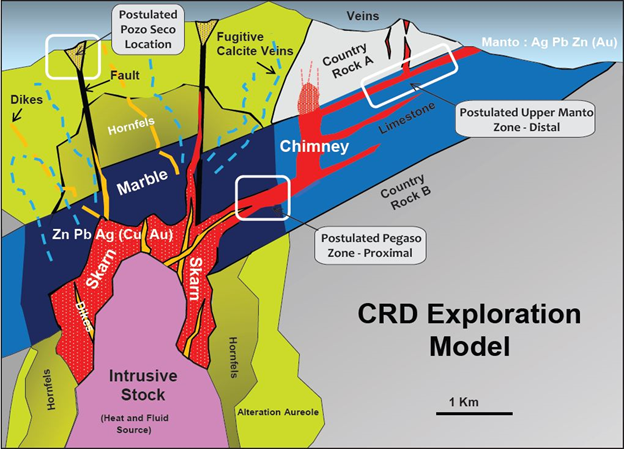

The Upper Manto is believed to be a Carbonate Replacement Deposit (“CRD”) types and has many geological and mineralogical characteristics in common with the largest CRDs in Mexico. CRDs are Phanerozoic, high-temperature (>250oC) deposits consisting of major pod, lens, and pipe-shaped Pb-Zn-Ag-Cu-Au skarn and massive sulphide bodies which transgress the stratigraphy of their host carbonate rocks and are commonly associated with igneous intrusive and extrusive rocks.

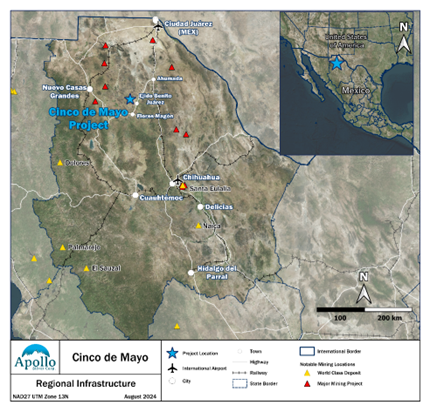

CRDs have contributed 40% of Mexico’s historic silver production, making them second only to epithermal veins. The largest CRDs in Mexico range from 10 million tonnes to over 100 million tonnes in size and define a belt measuring 2,200 km long by 20 km to 50 km wide. The Upper Manto deposit represents a major discovery along this trend. CRDs are commonly mined at rates of 2,500 tpd to over 6,000 tpd, with mining depths in several exceeding 1,200 m below surface.

CRDs are zoned over thousands of metres laterally and hundreds to thousands of metres vertically from central intrusions with mineralized skarn lenses along their flanks to mineralized skarns along dike or sill offshoots; to vertical to steeply oriented tabular or tubular “chimneys” composed dominantly of massive sulphides; to flat-lying tabular elongate “mantos” composed of massive sulphides; to a distinctive series of alteration styles that may extend for additional hundreds of metres from sulphide mineralization. The dominant metals change with distance from the source intrusion, with the highest silver grades occurring in the distal manto-dominated components of the system.

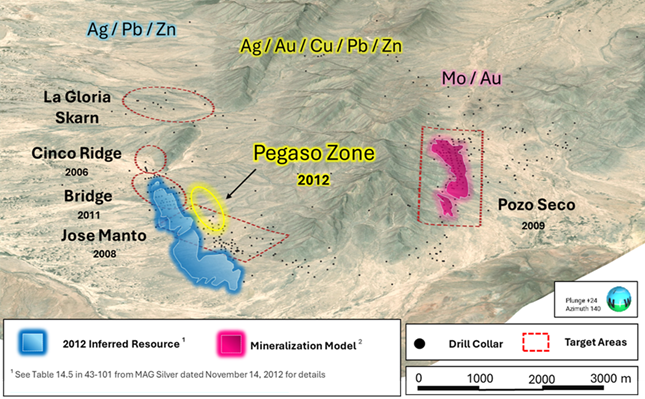

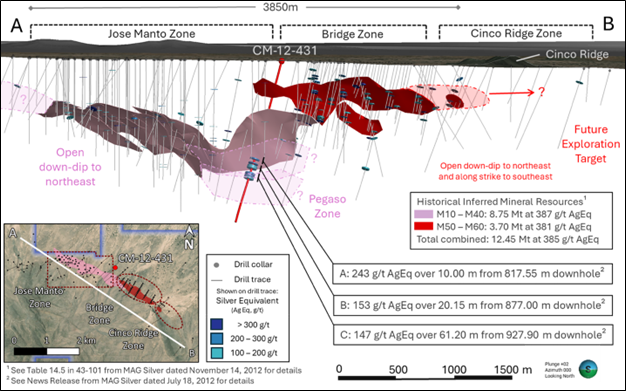

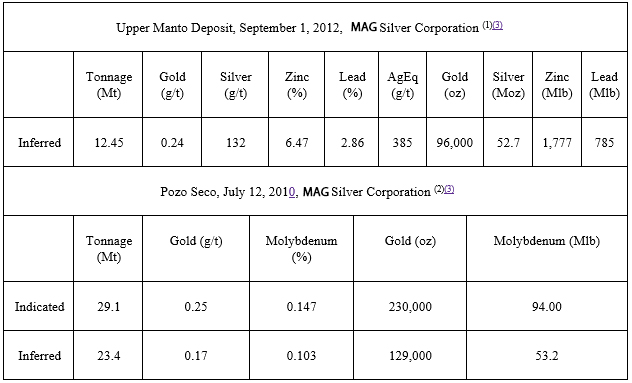

As of September 1, 2012, 445 holes totaling 213,591 meters (“m”) had been drilled on the Project by the previous operator, and no work has been completed since. Of these, 151 holes totaling 97,610 m are located at or nearby the Upper Manto deposit and were used to model the mineralization. Roscoe Postle Associates Inc. (“RPA”) prepared a technical report and Inferred Mineral Resource, dated November 14, 2012. At a Net Smelter Return (“NSR”) cut-off of US$ 100 per tonne. The resource was estimated at 12.45 million tonnes of 132 g/t silver (Ag), 2.86% lead (Pb), and 6.47% zinc (Zn), 0.24 g/t gold (Au) (Table 1). The total contained metals in the resource are 52.7 million ounces of Ag, 785 million pounds of Pb, 1,777 million pounds of Zn, and 96,000 ounces of Au.

* The reader is cautioned not to treat this historical estimate for the Upper Manto Ddeposit or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to the table below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

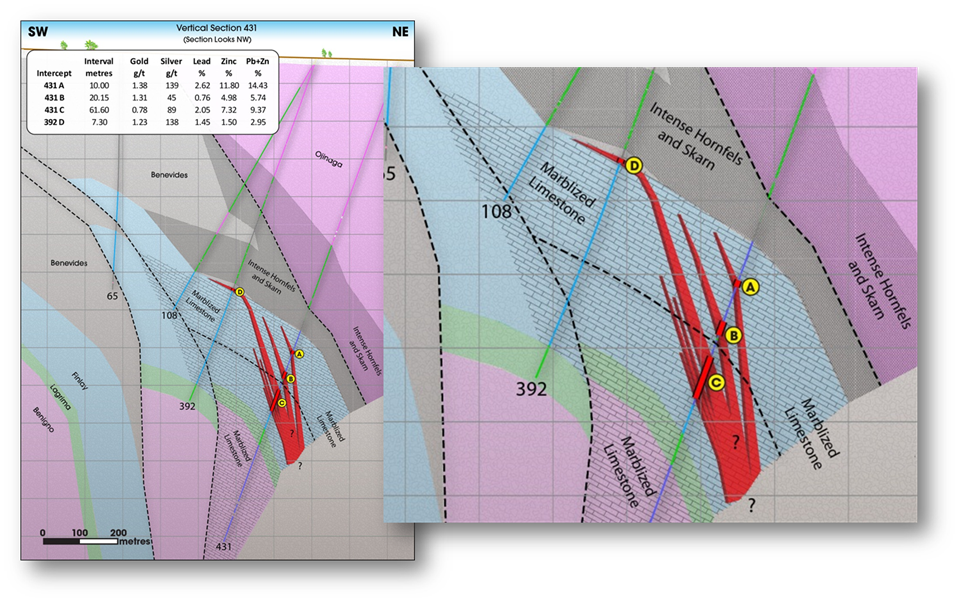

A potential new discovery, called the Pegaso Zone, was drilled in 2012. Consisting of 61.6 m of massive sulphide in a deeper hole (CM-12-431), it was not included in the 2012 historical resource estimate (Figure 2). This intercept is considered a high priority target and has potential to be a significant new discovery. The Company’s initial review of historical data suggests that the Pegaso Zone could indicate a larger and higher-grade resource at depth.

* The reader is cautioned not to treat this historical estimate for the Pozo Seco Mo-Au deposit, or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

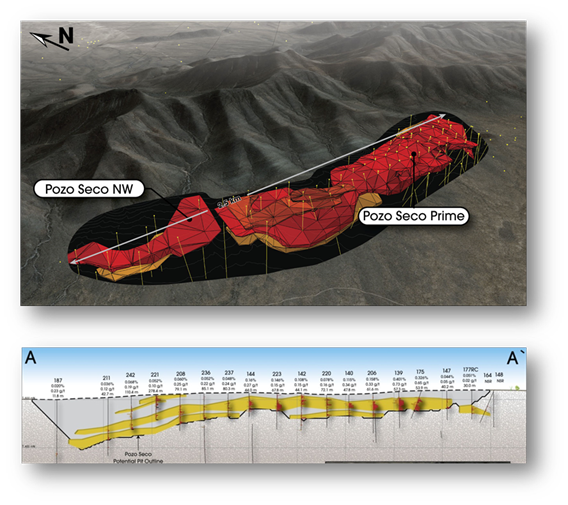

The Pozo Seco Historical Mineral Resources estimated by RPA with an effective date of July 12, 2010. The cut-off grade of 0.022% Mo was estimated using a Mo price of US$17/lb and assumed operating costs and recoveries. See MAG Silver press release dated August 4, 2010, for details.

The reader is cautioned not to treat this historical estimate or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

Cautionary Notes on Historical Resource Estimates:

In 2012, MAG Silver reported at an NSR cut-off of US$100/t, an Inferred Mineral Resources for total 12.45 million tonnes of 132 g/t Ag, 0.24 g/t Au, 2.86% Pb, and 6.47% Zn. The total contained metals in the historical resource were 52.7 million ounces of Ag, 785 million pounds of Pb, 1,777 million pounds of Zn, and 96,000 ounces of Au. The Upper Manto Deposit historical mineral resource estimate (2012) was prepared by David Ross, M.Sc., P.Geo., of RPA, an independent Qualified Person from MAG Silver. The 2012 Technical Report had an effective date of September 1, 2012. This Technical Report conformed to NI 43-101 Standards of Disclosure for Mineral Projects. Please see MAG Silver news release dated October 12, 2012, for more information on the 2012 MRE. In addition, the reader is directed to the NI-43-101 that was filed by MAG Silver on SEDAR+.

In 2010, MAG Silver reported at a cut-off grade of 0.022% Mo, an Indicated Mineral Resource for a total of 29.1 million tonnes grading 0.147% Mo and 0.25 g/t Au and containing 94.0 million pounds Mo and 230,000 ounces of Au. In addition, the Inferred Mineral Resource was estimated at 23.4 million tonnes grading 0.103% Mo and 0.17 g/t Au, containing 53.2 million pounds Mo and 129,000 ounces Au. The Pozo Seco Mineral Resource Estimate (2010) was prepared by David Ross, M.Sc., P.Geo., of RPA, an independent Qualified Person from MAG Silver. The 2010 Technical Report had an effective date of July 12, 2010. This Technical Report conformed to the NI 43-101 Standards of Disclosure for Mineral Projects. Please see MAG Silver news release dated August 4, 2010, for more information on the 2010 MRE. In addition, the reader is directed to the NI-43-101 that was filed by MAG Silver on SEDAR+.

Key assumptions and method used:

For the Cinco de Mayo, Upper Manto Deposit, the 2012 Historical Mineral Resources was estimated at an NSR cut-off value of US$100 per tonne. NSR values were calculated in US dollars using factors: Ag ( $0.60 per g/t), Au ( $12.32 per g/t), Pb ($18.63 per %) and Zn ($14.83 per %). These factors were based on metal prices of US$27.00/oz Ag, US$1,500/oz Au, $1.15/lb Pb, and $1.20/lb Zn and estimated recoveries and smelter terms. The values were capped to 1,000 g/t Ag, 4 g/t Au, 18% Pb, and 24% Zn. Grade interpolations for Ag, Au, Pb, Zn, and density were made using inverse distance cubed (ID3 ). The rResources wasere reported in-situ.

For the Pozo Seco Deposit, the 2010 Historical Mineral Resource estimate was estimated at a cut-off grade of 0.022% Mo. The cut-off grade was calculated using the following variables: surface mining operating cost (US$1.60/t), processing costs (US$5.00/t), general and administrative costs (US$1.50/t), Mo price of (US$17/lb), Au price (US$1,050/oz), and metal recoveries (Mo 90%, Au 70%). Grade interpolation of Mo and Au were made using ordinary kriging. The resource was reported within a preliminary open pit shell.

Work needed to bring the Cinco de Mayo Project mineral resources it to current:

In order to bring Cinco de Mayo historical mineral resources current for both the Upper Manto and Pozo Seco Deposits, Apollo would need to conduct a review the historical database, update the metal prices, recovery and NSR factors, and update the geological and resource models. Apollo has engaged an independent consultant and Qualified Persont (“QP”), to complete that work on the Upper Manto Deposit, and in addition, the QP is expected to complete a site visit and an independent resource estimate and technical report. The resource estimate at the Upper Manto Deposit will be prepared in accordance with the requirements of the Canadian Institute of Mining Metallurgy and Petroleum’s (“CIM”) National Instrument 43-101 (NI-43-101).

The scientific and technical data contained in this presentation was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Minerals Projects and is not an independent of the Company.