Four Paths to Growth: Apollo’s Calico Project

I was approached to run Apollo because of my track record as a mining executive and my experience in building and leading successful technical teams. A big part of the reason I accepted the role is the quality of the company’s two projects, the flagship being Calico.

Let me explain how I look at these things as a geologist, mining CEO, and as an investor. If a company is serious about building the next silver exploration and development powerhouse, it needs a project like Calico. It has size, location, and multiple avenues for growth. With the right approach, Calico has the potential to deliver not just growth but growth with some serious momentum.

Value Growth Through Resource Development

Let’s start with the resource development path. For those of you who might be new to the Apollo story, Calico is already one of the largest, undeveloped primary silver projects in the US. It has 110 Moz at 100 g/t Ag sitting in the Measured & Indicated category1, and a further 51 Moz at 86 g/t Ag in the Inferred category2. So, it’s a very large, high confidence resource and most of it is sitting near surface.

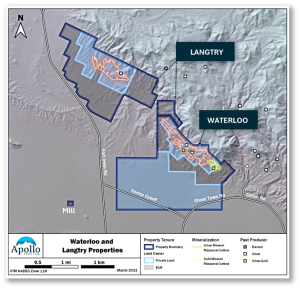

Near surface mineralization is a major advantage for any mining project because it saves time and money at every stage of advancement. In our case, it’s part of what gives our Waterloo deposit its low strip ratio of 1:1.1. Strip ratio refers to the amount of waste rock that must be removed to extract a unit of ore. In the case at Calico, we have relatively very little waste rock to remove, in order to mine ore. With such an attractive ratio, the Waterloo deposit at Calico has all the attributes of a particularly efficient open pit operation.

So, Calico has the potential to be bulk minable. It also has a small environmental footprint, is primarily on private land with vested mining rights, and it is not impacted by national parks or indigenous issues. Oh yes, and it’s less than 5km from commercial power lines and less than 15km from a town and accompanying rail facility. As a major added bonus, we are also sitting in California’s San Bernardino County – the most pro-mining jurisdiction in the entire state.

Put all of this together and you have a low-risk path for asset development and that’s why, over the coming months, we will be positioning the company to move towards the start of a preliminary economic assessment (PEA) for Calico.

Value Growth Through Silver Exploration

The size and quality of Calico’s resource speaks to the money that has already been invested in the project, and it should give you an indication of just how well we understand the geological model. Put another way, when it comes to silver mineralization at Calico, we are confident that there is more – possibly a lot more – to uncover.

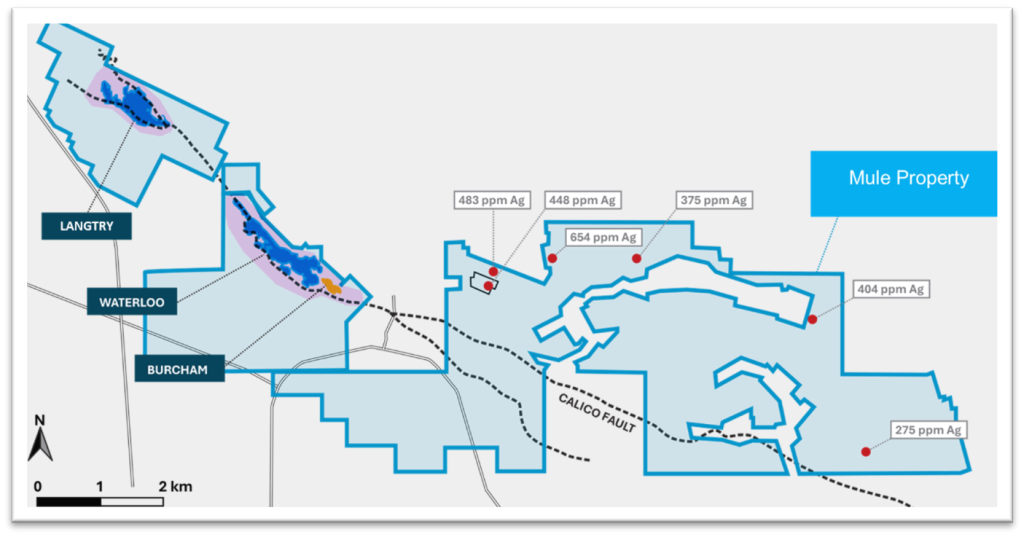

It’s this potential that led to our land package expansion earlier this year. Research by our technical team uncovered a series of sampling locations – with historical results as high as 654 ppm Ag – starting just 3km east of the Waterloo deposit. The addition of what we refer to as the Mule property grew the Calico package by 285% and gave us multiple new high priority areas to target with exploration programs. Within the coming months, you can expect to see more from us on regional exploration activities.

Value Growth Through Critical Minerals

Calico has a lot of contained silver, and it also happens to host a lot of barite associated with the silver. Now, barite was placed on the US critical mineral list in 2023 because of its importance for the medical and energy sectors. The US, which is the world’s biggest consumer of barite, imports around 75% of its requirements – mostly from India and China.

The presence of barite at Calico is important for a couple of reasons. Firstly, there is the potential for significant barite credits during production (historical estimate of 4.5 Mt barite). Secondly, having a critical mineral component at the project gives us an opportunity to accelerate the permitting process as we move through development. The US has made no secret of its intention to become self reliant in critical minerals, and it plans to so at speed. China has achieved a dominance in critical mineral production that has serious global implications both militarily and commercially. As a result, anything on the US critical mineral list has the chance to be fast tracked at the permitting and licensing level. Already we are seeing this come into play with dozens of critical mineral projects being fast tracked in the last few years, including uranium, copper, nickel, palladium, and titanium. While silver is a strategic rather than critical mineral, we have also noted the recent fast tracking of a silver project in Alaska.

Secondly, having a critical mineral component at the project gives us an opportunity to accelerate the permitting process as we move through development. The US has made no secret of its intention to become self reliant in critical minerals, and it plans to so at speed. China has achieved a dominance in critical mineral production that has serious global implications both militarily and commercially. As a result, anything on the US critical mineral list has the chance to be fast tracked at the permitting and licensing level. Already we are seeing this come into play with dozens of critical mineral projects being fast tracked in the last few years, including uranium, copper, nickel, palladium, and titanium. While silver is a strategic rather than critical mineral, we have also noted the recent fast tracking of a silver project in Alaska.

Altogether, these benefits of having a critical minerals component are attractive enough that we have already set things in motion to update our resource estimate in Q3 of this year with a barite resource.

Value Growth Through High-Grade Gold Exploration

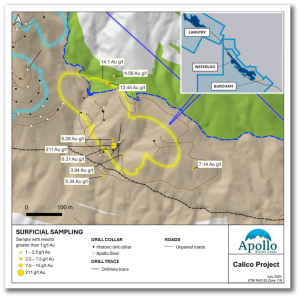

We have silver, we have barite and yes, we have gold. In addition to its huge silver component, our Waterloo property has an inferred resource that includes 70,000 Mt Au at an average grade of 0.5 g/t Au1. Where things get interesting with Calico’s gold is when we look at the regional exploration potential.

average grade of 0.5 g/t Au1. Where things get interesting with Calico’s gold is when we look at the regional exploration potential.

The deposit is proximal to the past producing Burcham mine, where historic public articles reported grades up to 0.31 ounces per ton (9.7 g/t). More interesting still are the results from surface sampling in 2022, which included results as high as 211 g/t Au and 849 g/t Ag at the Burcham mine area (see NR dated Feb 14, 2023), and also drilling in 2023, which defined a strike length in excess of 1km and remains open in all directions.

Thanks to these results, we know we have high-grade gold on the property and a clear area of focus for future drilling aimed at making a new discovery.

The Big Picture

Earlier this week, a new shareholder wanted to know, given the range of growth options before us, how were we going to prioritize? My answer was that we would be pursuing all options at the same time. The beauty of a project such as Calico is that we can advance the development of the existing deposits in parallel with adding a barite resource, exploring for more silver, and exploring for more gold.

We have a strong treasury, a team and board of directors with deep technical and corporate expertise, and a flagship project that most juniors can only dream of. With the silver sector going from strength to strength, and our Calico plans advancing, it’s going to be an exciting time for Apollo.

Please don’t hesitate to reach out to us with any question by emailing info@apollosilver.com or by calling +1 604 428 6128.

Ross McElroy

President and CEO of Apollo Silver

Forward Looking Information. Apollo Silver CEO Blog posts may contain forward looking statements. Please refer to our cautionary statement for further information.

1 For the Waterloo Property, cut-off grade was calculated using the following variables: surface mining operating costs (US$2.75/st), processing costs (US$20.00/st), general and administrative costs (US$3/st), silver price (US$23.50/oz), gold price (US$1,800/oz), and metal recoveries (silver 65%, gold 80%). Resources reported are constrained to within a conceptual economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver and 0.3 ppm (0.30 g/t) gold. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). Silver grade was capped at 450 g/t and gold was capped at 2 g/t for the Waterloo estimate only.

2 No drilling was completed on the Langtry Property since the declaration of the 2022 MRE and as such, the Inferred mineral resource announced February 9, 2022, for the Langtry Property remains unchanged and current. The 2022 MRE was prepared by Derek Loveday, P. Geo. of Stantec, an independent Qualified Person. Cut-off grade for the Langtry 2022 MRE was calculated using surface mining operating costs of US$2.50/st, processing costs of US$29.00/st, silver price of US$23.00/oz and silver recovery of 80%. The Langtry resource is constrained to within a conceptual economic pit shell targeting mineralized blocks with a minimum of 50 ppm (50 g/t) silver. Please refer to news release dated February 9, 2022 for more information on the 2022 MRE.